Copyright ©2021 VINAMR All Rights Reserved

31 Aug 2020

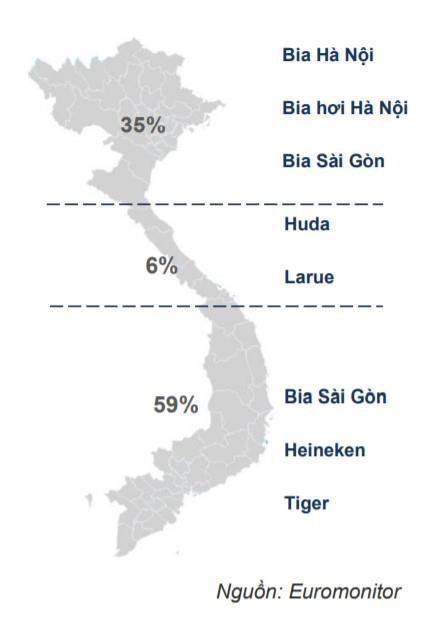

Hanoi Beer is the leading beer in the North, but this region only accounts for 35% of the total consumption of the entire beer industry in Vietnam. Meanwhile, this brand is fading in the South.

After ThaiBev approved the legal entity Vietnam Beverage acquired 53.6% capital of Saigon Beer – Alcohol – Beverage Corporation (Sabeco), Hanoi Beer – Alcohol – Beverage Joint Stock Corporation ( Habeco) is the last big man in the Vietnamese beer market that has not yet been dominated by a foreign giant. Currently the state capital in Habeco accounts for 81.7% while the Carlsberg group holds 17.3%.

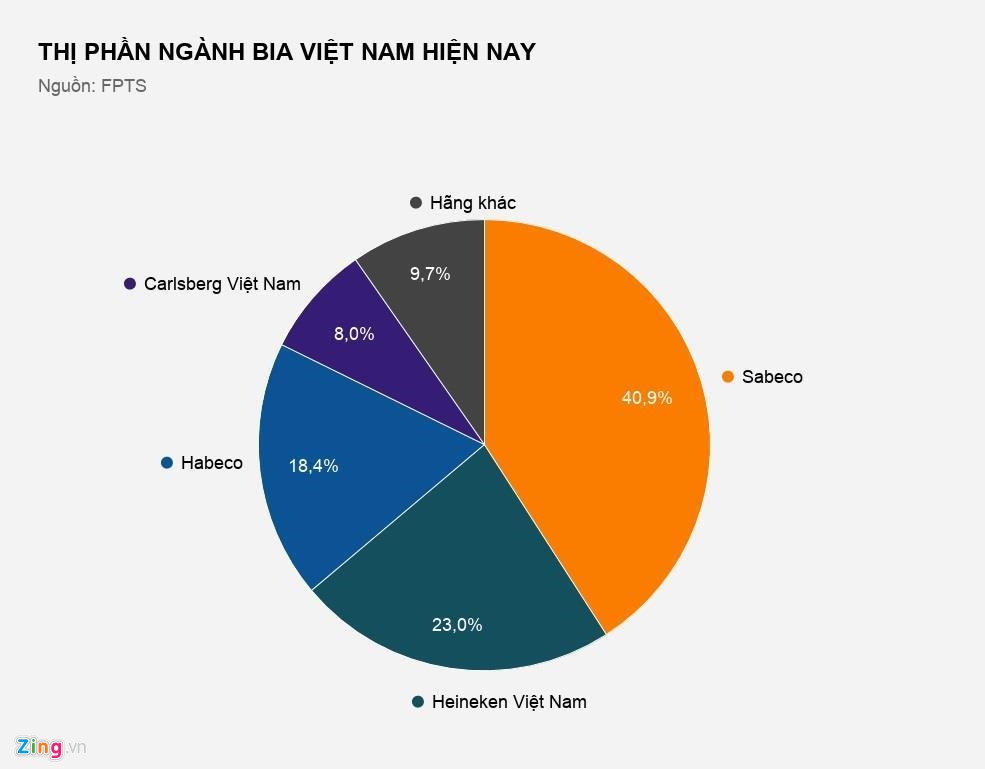

Habeco with products branded Hanoi Beer is competed fiercely by rivals Sabeco and Vietnam Brewery Company Limited (VBL – Heineken Vietnam) – owners of brands Heineken, Tiger and Larue. According to FPTS Securities Company, Habeco’s market share at the end of 2018 was only 18.4%, Heineken Vietnam accounted for 23% and Sabeco owned 40.9%.

The market share of Habeco’s beer pie has been smaller since the company was captured by Heineken Vietnam at the second position in the market. The last time Habeco was still above compared to VBL was 2014. At that time, 20% of the Vietnamese beer market was in the hands of the owner of Hanoi Beer, while the owner Heineken had only 19%.

In terms of production scale, Habeco is also weaker than its once brother Sabeco and foreign rival Heineken. According to FPTS statistics, at the end of 2018, Habeco has 17 factories with a total capacity of 810 million liters per year. VBL has 6 factories with a total capacity of 950 million liters and Sabeco has 23 factories with a total capacity of 1.8 billion liters.

Absent in the South, lackluster in the high-end segment

Hanoi Beer is still the leading brand in the North, but this region accounts for only 35% of the total consumption of the entire beer industry in Vietnam. Meanwhile, the region with the strongest beer consumption in the country is the South with 59% and Saigon Beer market dominates absolutely.

In addition, despite being behind Habeco and Hue Brewery (owned by Carlsberg) in the North and Central, Sabeco and Heineken Vietnam still cover the distribution system in these two regions and have a foothold in the market.Meanwhile, the presence of Hanoi Beer brands in the South is weak.

Having just moved to Ho Chi Minh City to live for nearly half a year after graduating from university in Hanoi, Hai Ha said that she regularly chooses Saigon Special beer next to Truc Bach, a Habeco brand, when gathering with friends in the still in the capital. “Since coming to Saigon, I’ve only had one drink of Truc Bach at a pub and have never seen Hanoi Beer,” she said.

Map of beer consumption and prominent brands by region in Vietnam. Photo: FPTS.

In Habeco’s current brand portfolio, apart from the two newly launched brands this year, Hanoi Bold and Hanoi Light, only Truc Bach is in the premium segment. In contrast, Hanoi Beer brands are targeting the mid-end and affordable segments.

Meanwhile, the FPTS report stated that the growth rate of the low-priced beer segment was only 4.8%, but the premium beer was up to 15% in the period 2014-2017.

Therefore, the high-end segment, although only accounting for more than 10% of the total consumption of the market, is where beer enterprises increasingly focus on competition thanks to higher profitability. However, participating in the high-end segment also requires the giants to have a more methodical business strategy.

Not only Hanoi Beer, many Vietnamese beer brands also lose their positions in the competition to find a place in the premium beer market like Heineken. FPTS believes that Heineken Vietnam has experience in selling high-end products and has the advantage of inheriting marketing campaigns from its parent company.

Saigon Special beer, thanks to the strategy of hiring foreign consultants, has gained many positive results and has gained the second market share in the high-end segment. Meanwhile, before launching two new beer products earlier this year, Habeco could not achieve the expected position in the premium beer market under the Truc Bach brand name.

Profits decreased steadily

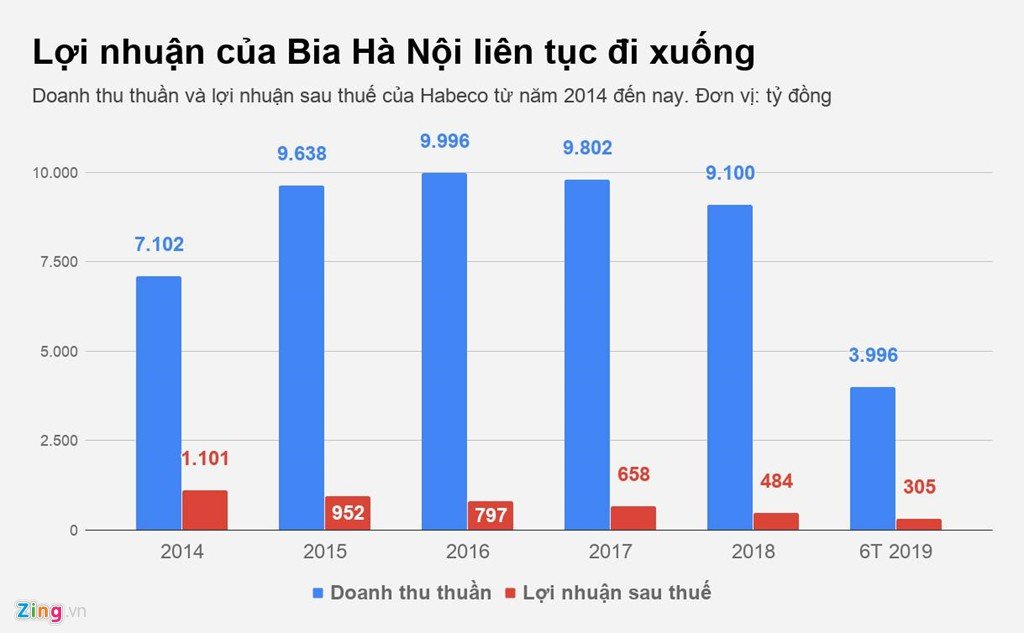

In the first 6 months of 2019, Habeco achieved net revenue of VND 3,996 billion, 8% lower than the result of VND 4,338 billion in the same period last year. Habeco’s after-tax profit also dropped by 6% from 325 billion dong to 305 billion dong. This is Habeco’s lowest semi-annual net profit in the past 4 years.

In fact, Habeco’s business results have been in the bleak for a long time. Over the past 5 years, Habeco’s after-tax profit has steadily declined. In 2014, Habeco earned a profit of 1,101 billion dong, but by the end of 2018, corporate profit has decreased by more than half, to only 484 billion dong.

The most recent fiscal year, Habeco did not fulfill important business targets. Consumption volume of major products of Habeco in 2018 was 429.4 million liters, equal to 89% over the same period last year and equivalent to 86% of the plan.

Sales of main products reached VND 7,558 billion, equal to 96% of the same period and completed 85% of the plan. Profit before tax reached VND 637 billion, equal to 76% over the same period and equivalent to only 64% of the plan.

Habeco’s Board of Directors said that the North and North Central markets – the main consuming regions of Habeco products – grew negative 3% compared to 2017. Meanwhile, Habeco admitted that its products were subject to fierce competition. While rival brands such as Saigon Lager and Sabeco’s 333 grew 32%, Heineken’s Tiger grew 71%.

In addition, the special consumption tax has also increased from 60% to 65%, putting pressure on the profit targets of beer industry units. In addition, the price of raw materials for beer production such as malt, rice, houblon flower, cans increases, making production costs increase, pushing profits down.

In 2019, Habeco’s expected net profit is only 310 billion dong, at the lowest level in 10 years. However, with this record low profit target, Habeco has fulfilled 98% of its full year profit target after 6 months.

Việt Đức

Source: Zing