Copyright ©2021 VINAMR All Rights Reserved

07 Oct 2020

When a customer transfers money, at least the banking system must send 3 messages to the remitter and receive the money, not to mention a customer who is late in entering the OTP or incorrectly entered … the bank must send it again.

Although the current fee for e-banking services of major banks is considered quite high compared to the general level, the leaders of these banks said that there are still some banking services that are not enough to compensate. chi.

* Not collect fee effectively

Assessing the fees of the current banks, finance and banking expert, Dr. Nguyen Tri Hieu said that, at present, banks are offering a lot of fees such as card issuance fees, statement fees, Money transfer fees, withdrawal fees … make customers hesitate when setting up a bank account as well as using electronic payment services.

Mr. Hieu gave an example, in the US issuing an ATM card or wanting to make an account statement, the customer does not lose any fees, because when the customer uses the service and deposits money into the account, the bank issues the card to them. of course.

Meanwhile, with Vietnamese banks there are too many fees: opening cards, card statements, using cards … all have fees. This is one of the factors that hinder non-cash payments.

According to Mr. Hieu, customers deposit money into their accounts, banks use that money to profit. Therefore, the bank will pay back the customer by offering superior services.

Mr. Hieu suggested that, in order to promote non-cash payments, banks can consider reducing and adjusting fees appropriately. The bank may also offset such fees by increasing guarantee fees.

According to Mr. Hieu, the fact that some banks do not charge fees will benefit from the demand balance of the accounts, on which the bank can exploit that idle capital. In the long term, the payment fee will be reduced, instead of insurance services.

* Banks still have to cover losses

One issue that many customers have commented is that the transfer fee inside and outside the banking system is quite high, while some other banks are free.

Explaining this issue, Mr. Vu Khac Truong, Deputy Head of Vietcombank Retail Product Policy Department, said: “Being one of the banks with the largest number of individual customers and also one of the investment banks. In the large part of the information technology system, we find that the fees charged by Vietnamese banks are not high at present. “

Accordingly, Mr. Truong explained, Vietcombank as well as banks have to pay many types of service fees (for OTP messages to authenticate transactions, costs to pay for digital banking solutions, intermediary fees are NAPAS / State Bank of Vietnam for inter-bank money transfers, carrier charges for messages sent to customers), so in fact, Vietcombank is still having to compensate for money transfer services.

Specifically, Mr. Truong analyzed: In a month, Vietcombank had to send a lot of SMS to customers such as balance fluctuations and other transactions of customers, while the bank only collected 11,000 VND / month … While Meanwhile, when the customer transfers money, at least the Vietcombank system must send 3 messages to the customer to transfer and receive money, not to mention that there are customers who are late in entering the OTP code, and then enter incorrectly … the bank must send it again. .

In fact, for verifying customers who register for the service, the bank must send the customer at least 2 SMS, OTP, to verify customer’s phone number information and successfully submit registration information. For payment transactions, the bank must send customers at least 2 SMS, OTP, to authenticate the transaction and inform the balance change.

For withdrawal transactions, banks must send customers at least 1 SMS to send the balance change notice. As for other support requirements, the bank must send at least 3 SMS including sending abnormal transaction alerts, OTP verifying transactions and notification of results.

“When offering this fee, Vietcombank has also consulted the fees of other banks in the market and also set this fee at a level that is competitive with other competitors, but cannot be too high,” Mr. Truong said. strong.

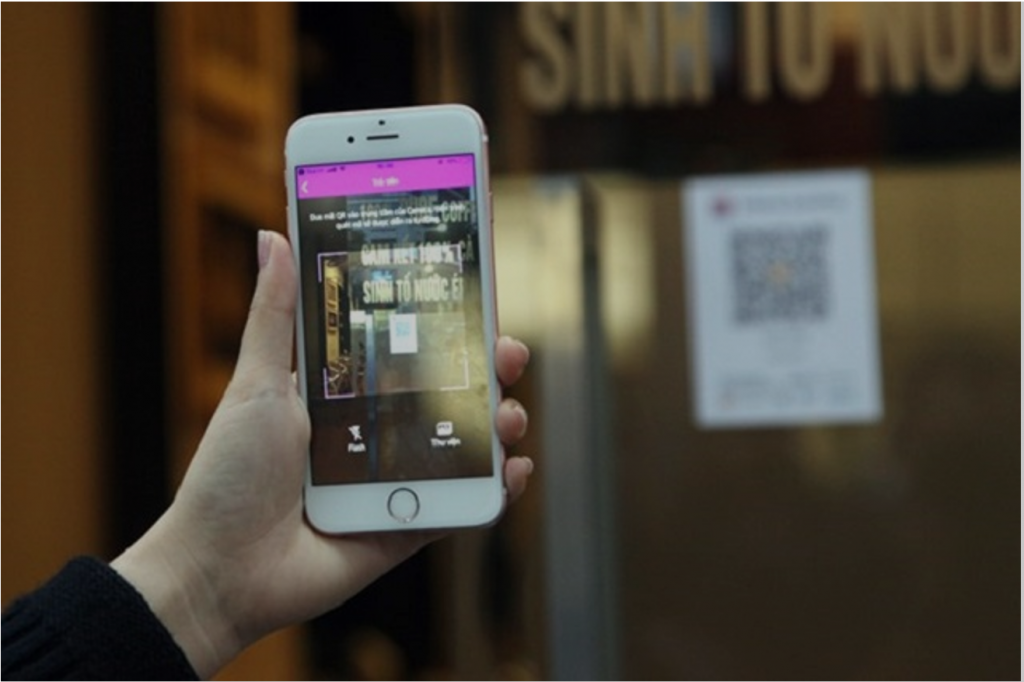

TPBank is one of the banks that waives many types of fees for customers. (Photo: Vietnam +)

In addition, the bank has to invest a lot to develop the information technology system to ensure that the system runs continuously and without errors, so it is the fact that Vietcombank collects fees for maintaining banking services. Electronic goods are based on when providing such services.

Along with the above point of view, Mr. Nguyen Chien Thang, Director of BIDV Digital Banking Center also analyzed that the proportion of fee collection of Vietnamese banks, not exceeding 10% of the bank’s total income, is very low.

“I admit, Vietnamese banks are heavily dependent on old technology, not smart enough, making users feel withdrawn, but in fact, the bank’s fees are only enough to cover costs. For example, for an interbank money transfer, the lowest total cost is about over 5,000 VND / transaction, ”said Mr. Thang.

The bank is ‘paying’ the SMS fee paid to the carrier

According to Mr. Vu Khac Truong, one of the costs Vietcombank is having to cover the most loss is the SMS service that banks have to pay the network operator so that they can provide messaging services to customers.

The cost of sending text messages from businesses to carriers is currently being charged much higher than individuals sending each other. Based on the actual payment by banks over the years, the average SMS fee is about 700 VND / message. Meanwhile, for individual customers, this fee is from 250-350 VND / message.

In a petition to reduce the SMS fee for banking and financial services with telecom operators, Mr. Nguyen Toan Thang, General Secretary of the Banking Association also explained the reason for the banks’ fee collection. .

“In fact, a bank free of charge for customers has to pay and suffer a loss for the average text message fee of 1,640 VND / payment transaction. On average, each customer has 15-20 transactions / month, equivalent to 25-30 messages / month, equivalent to about 20,000-25,000 VND / month. Meanwhile, the price of text messages that telecom businesses are applying to banks is 3 times higher than that of ordinary text messages. Every month, a small-scale bank that generates about 9-11 million messages / month has to pay the telecom business between VND 7.5-9 billion / month, ”said Mr. Thang.

Mr. Thang also gave a specific example at BIDV, SMS output increased over the years: In 2017, there were 365.58 million messages; 2018 was 473.62 million items; In 2019, there are 635.48 million and the first 5 months of 2020 there are 320.38 million.

Thus, the total output of the 3 years and the first 5 months of 2020 is approximately 1,900 million VND, the cost is about 1,200 billion VND. Based on the pace of message output this year, BIDV estimates that it will have to offset a loss of about 500 billion dong.

Therefore, according to the fact that the leaders of the Banking Association have suggested that if the carriers apply the normal price as with individual customers, the SMS service cost will be reduced by about 50% (BIDV will reduce offset losses of about 285 billion).

“This will facilitate banks to reduce fees, lower lending interest rates for customers as well as promote non-cash payments through further reducing payment transaction fees for customers. , ”Mr. Thang emphasized.

Thuy Ha

VIETNAM PLUS