Copyright ©2021 VINAMR All Rights Reserved

08 Oct 2020

After the SBV’s decision to lower interest rates on September 30, 2020, is the 3rd executive interest rate lowering decision since the beginning of the year, plus a period of lowering important interest rates, the cost of capital already exists. conditions to return to a new low.

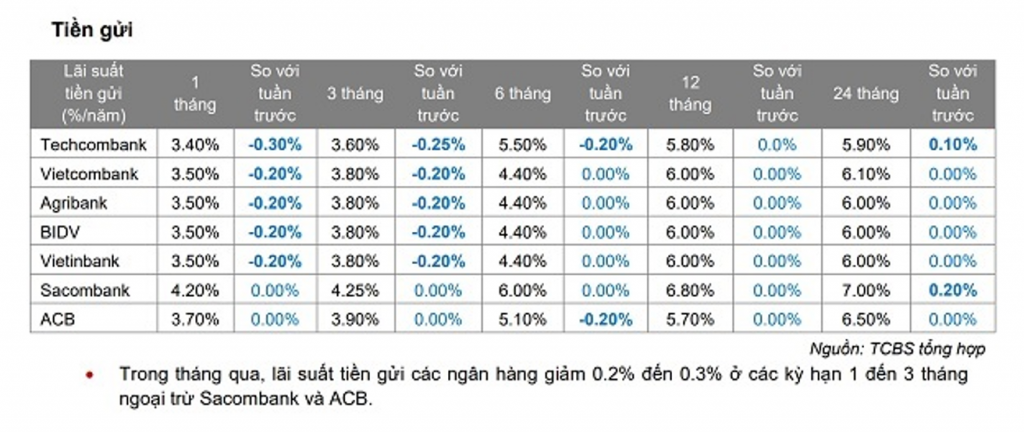

Before the State Bank lowered the operating interest rate, the mobilized capital level was adjusted by commercial banks to decrease by 0.2-03% (according to TCBS), and on average decreased by 0.4% in the whole system (according to SSI).

In terms of general principles, lowering interest rates has the main goal of stimulating the economy, businesses have the opportunity to borrow cheap capital to restore business and expand operations. This is a very important decision, especially at times of weakness. The US Federal Reserve (FED) has also lowered interest rates to 0% and plans to extend this interest rate until the economy recovers, along with the unemployment rate falling, and the employers have increased.

As a general rule, when interest rates drop occurs, capital can flow into real estate and this will be a benefit channel.

However, it must be further detailed that the lowering of interest rates can come from a cause or a consequence. For example, cutting interest rates to extremely low levels according to the will to operate the market to save the economy, is the case of the Fed and comes from the cause. And lowering interest rates because the credit system lacks borrowers, excess capital, that is the consequence. In this case, the real estate investor, contrary to the general principle, is unlikely to borrow. The pandemic and unclear prospects of the real estate market make most real estate investors worried and do not want to invest.

On the banks side, although the credit has not grown as expected, and banks have had to lower the lending interest rates to a very low level, accepting to reduce their profits to reach the capital target. But banks still choose to only disburse safe capital. Loans with valuable real estate collateral will have better access to capital. And accordingly, the bank still wants to lend most strongly is the real estate sector.

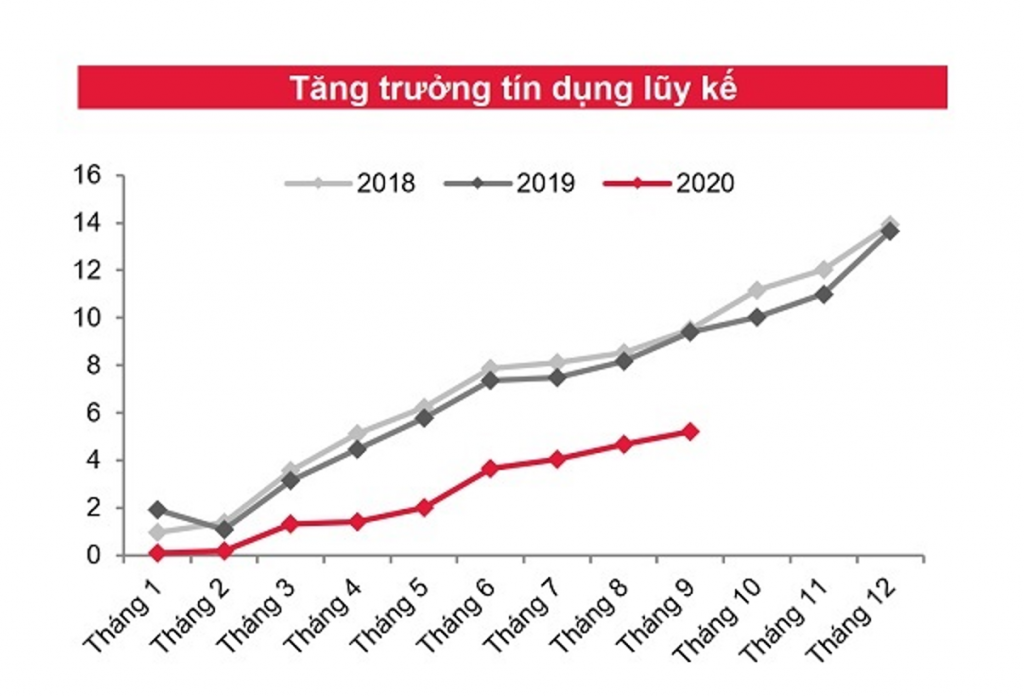

Credit growth but was significantly lower than the growth line of the 2 preceding years, reflecting poor capital absorption in the context of COVID-19 translation (source: SSI)

For production and business enterprises, it is not easy to choose a safe enterprise to lend while the COVID-19 translation is not completely over. So, even if interest rates have dropped to record, banks need to promote credit faster because most bank profits still depend on this traditional business, cheap capital will only help good businesses, such as “Tiger adds wings”. Businesses that are facing difficulties are still very difficult to get loans from banks.

However, once capital is cheaper, businesses still have a better chance if they choose from the angle: Do not look for low interest rates but accept a higher interest expense. Accordingly, it is difficult for businesses to still have the door for banks to loosen their loan appraisal. The higher interest rate is for the bank to compensate, prevent and balance risks, if any. And although capital can bear at a higher price level, in fact is still cheaper than usual, is a good resource for businesses to overcome difficulties, offset costs when imbalance, need good cash flow to ensure continue to do business.

In addition, the reduced interest rate, cheap capital will also be a reward for individual and institutional investors who still have cash, capital, and have reciprocal conditions to borrow a part of low-interest credit, to implement property purchases, shares, M&A. This may also be a channel to increase credit absorption from now to the end of 2020 and extend to the whole next year, according to the forecast that low interest rates can continue through 2021.

Positive signals for credit growth

According to TS. DINH THE HIEN – Economic Specialist Business Forum