Copyright ©2021 VINAMR All Rights Reserved

08 Aug 2020

The revenue and profit of the beer companies leading the market share in Vietnam both fell sharply in the first quarter, although they prospered again in the second quarter, the wave of Covid-19 was spreading again, continuing to put pressure on the business situation of this industry.

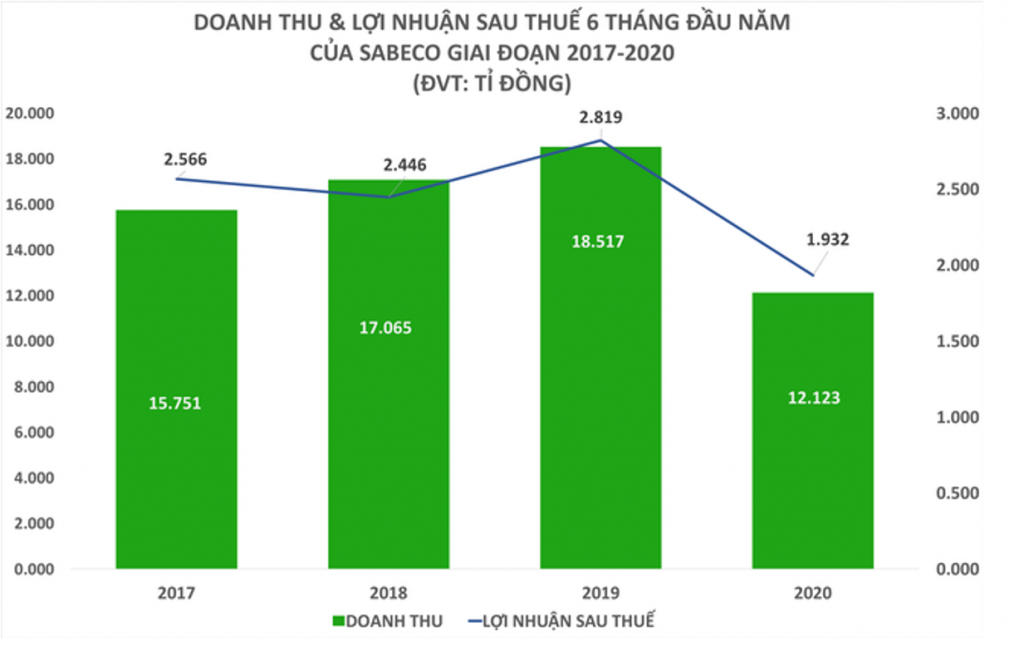

Sabeco – the market leader in beer market in Vietnam has just announced second quarter revenue, down 22% compared to the same period last year as VND 7,815 billion – bringing six-month turnover to VND12,123 billion, down 35% compared to the same period last year.

Declining revenue plus corporate loan interest expenses soared by nearly 180%, making the second quarter’s after-tax profit down 21% to VND 1,216 billion. In the first half of the year, Sabeco recorded 1,930 billion dong in profit after tax, down more than 30% of last year’s same period.

Sabeco’s management foresaw the effects of Decree 100 and the Covid-19 pandemic when it set a target of nearly 40% drop in revenue and profit in 2020 compared to 2019 – which is also the lowest target since In 2016. With the first half of the year business results, Sabeco completed 50% of revenue and 59% of the target profit of the year.

At the annual meeting of Sabeco shareholders at the end of June, the leader said that this business sees everything back to normal and “Sabeco will recover in parallel with the recovery of the economy”.

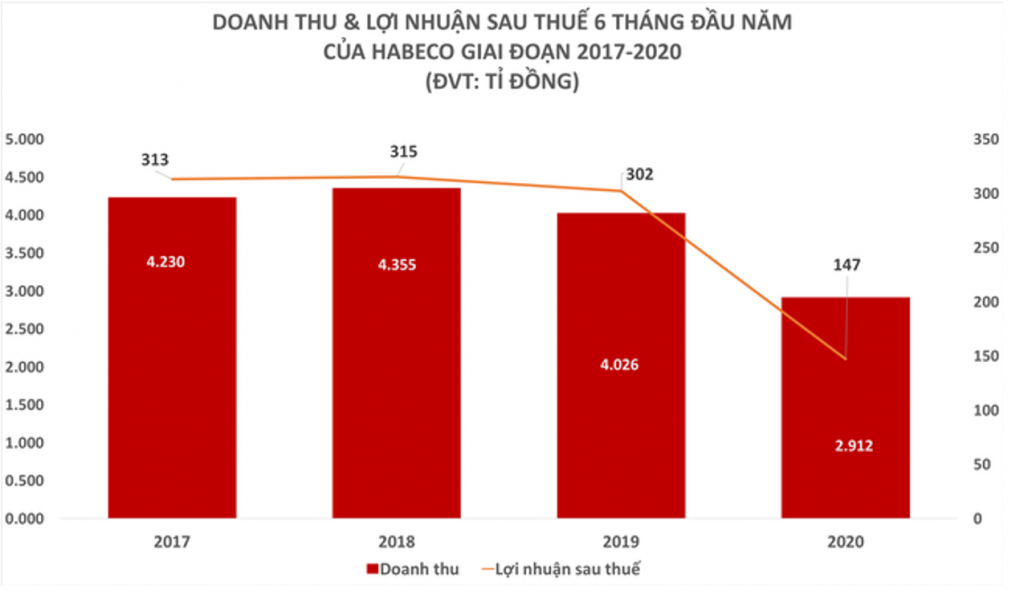

Also witnessing the first half of 2020 not going smoothly, the big man in the beer industry in the North – Hanoi Beer – Alcohol – Beverage Corporation (Habeco) reported 6-month net sales of 2,912 billion VND, down 29% compared to that of same period last year. In the second quarter alone, Habeco recorded VND 2,132 billion in revenue, equal to 83% of the same period in 2019.

Profit after tax in the second quarter increased slightly, but that in the first half of 2020 still plummeted 51% to 147 billion, although Habeco announced it had cut selling and administrative expenses.

Habeco’s 2020 revenue and profit targets submitted to the shareholders’ meeting in June are also down 44% and 51% year-on-year, respectively, to VND4,239 and 248 billion, based on the worst case scenario of the Covid epidemic- 19 will last until 2020. At the end of 6 months, Habeco completed 68% of revenue and 59% of profit.

Habeco’s revenue and net profit after tax also decreased by 2 digits in the first half of 2020 compared to the same period last year.

However, the group that owns many brands such as Heineken, Tiger, Strongbow … announced its net revenue and business profit from the whole Asia-Pacific region reached 21 million euros (572 billion dong) and 8 respectively. million euros (218 billion dong), of which Vietnam is one of the key markets, according to the first half of 2020 business report published by Heineken IV on 3.8.

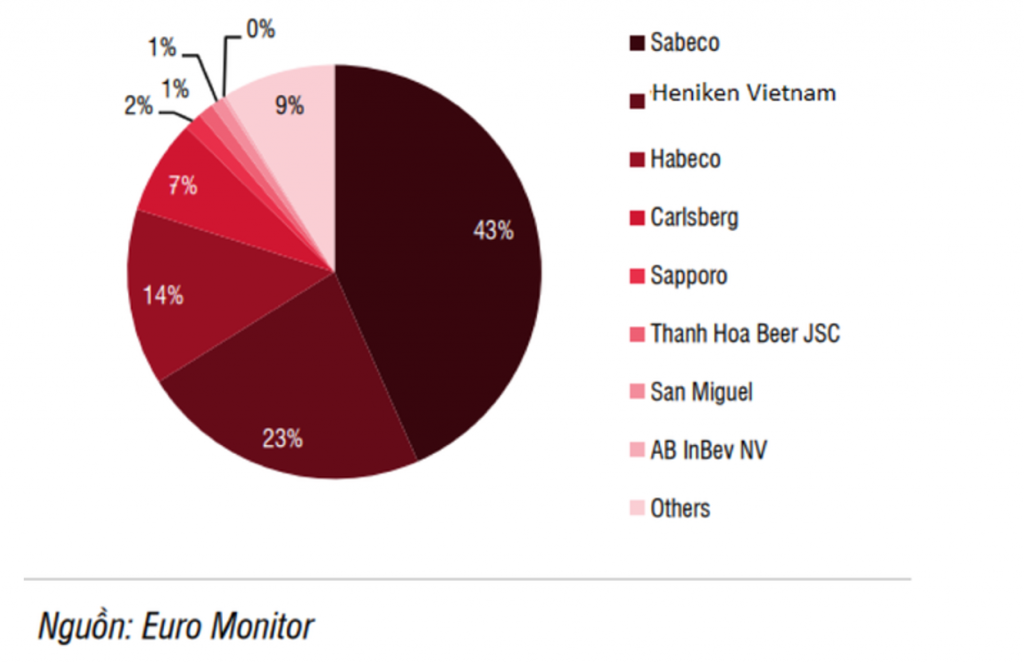

Heineken – the second largest company in market share in Vietnam after Sabeco, said total beer consumption in the Asia-Pacific region decreased by nearly 5% compared to the same period last year, bringing the region’s net sales lower. 10% over the same period.

The report says that beer consumption in Vietnam “has outperformed the whole region” and that the number of on-trade channels in Vietnam has begun to stabilize again. second quarter.

Carlsberg – a wholly owned group of Hue Brewery in its first quarter report estimated net sales in Asia decreased by 12.4%.

The Vietnamese market is characterized by the proportion of the on-trade channel that accounts for 73% of the total beer consThe revenue and profit of the beer companies leading the market share in Vietnam both fell sharply in the first quarter, although they prospered again in the second quarter, the wave of Covid-19 was spreading again, continuing to put pressure on the business situation. business of this industry.

Sabeco – the market leader in beer market in Vietnam has just announced second quarter revenue, down 22% year-on-year to VND 7,815 billion – bringing six-month sales to VND12,123 billion, down 35% compared to the same period last year. same period.

Declining revenue plus corporate loan interest expenses soared by nearly 180%, making the second quarter’s after-tax profit down 21% to VND 1,216 billion. In the first half of the year, Sabeco recorded 1,930 billion dong in profit after tax, down more than 30% YoY.

Sabeco’s management foresaw the effects of Decree 100 and the Covid-19 translation when it set a target of nearly 40% drop in revenue and profit in 2020 compared to 2019 – which is also the lowest target since In 2016. With the first half of the year business results, Sabeco completed 50% of revenue and 59% of the target profit of the year.

The head of Sabeco at the annual general meeting of shareholders at the end of June once said that this business sees everything back to normal and “Sabeco will recover in parallel with the recovery of the economy”.

Also witnessing the first half of 2020 not going smoothly, the big man in the beer industry in the North – Hanoi Beer – Alcohol – Beverage Corporation (Habeco) reported 6-month net sales of 2,912 billion VND, down 29% compared to that of same period last year. In the second quarter alone, Habeco recorded VND 2,132 billion in revenue, equal to 83% of the same period in 2019.

Profit after tax in the second quarter increased slightly, but that in the first half of 2020 still plummeted 51% to 147 billion, although Habeco announced it had cut selling and administrative expenses.

Habeco’s 2020 revenue and profit targets submitted to the shareholders’ meeting in June are also down 44% and 51% year-on-year, respectively, to VND4,239 and 248 billion, based on the worst case scenario of the Covid epidemic- 19 will last until 2020. At the end of 6 months, Habeco completed 68% of revenue and 59% of profit.

Habeco’s revenue and net profit after tax also decreased by 2 digits in the first half of 2020 compared to the same period last year.

However, the group that owns many brands such as Heineken, Tiger, Strongbow … announced its net revenue and business profit from the whole Asia-Pacific region reached 21 million euros (572 billion dong) and 8 respectively. million euros (218 billion dong), of which Vietnam is one of the key markets, according to the first half of 2020 business report published by Heineken IV on 3.8.

Heineken – the second largest company in market share in Vietnam after Sabeco, said total beer consumption in the Asia-Pacific region decreased by nearly 5% compared to the same period last year, bringing the region’s net sales lower (10% over the same period).

The report says that beer consumption in Vietnam “has outperformed the whole region” and that the number of on-trade channels in Vietnam has begun to stabilize again. second quarter.

Carlsberg – a wholly owned group of Hue Brewery in its first quarter report estimated net sales in Asia decreased by 12.4%.

The Vietnamese market is characterized by the proportion of the on-trade channel that accounts for 73% of the total beer consumption when the majority of consumers enjoy beer at the restaurant / restaurant …, according to the newspaper. Beverage market report of strategic research and consulting firm CDI. Therefore, factors affecting external consumption channels make revenue and profit of beer traders decline.

At the shareholders meeting in 2020, Sabeco president admitted that the two biggest challenges in 2020 are the impact from Decree 100 and social isolation measures that have caused “beer consumption in restaurants to decline significantly”.

With the disease situation returning from the end of July, breweries will continue to face the risk of reduced consumption until the end of 2020, along with the eating and spending habits of users also change.

Report on consumer behavior during the Covid-19 epidemic by Kantar Vietnam said that spending on “beer” products fell 24% in just the first two months of the year. Luxury goods, alcohol and “non-essential” products are forecast to be hit hard even after the epidemic ends.

SSI Research also forecasts that beer production growth in 2020 may not reach double digits, the growth will be stable at around 6-7% by the end of this year due to the impact of Decree 100 and the Covid epidemic- 19.umption when the majority of consumers enjoy beer at the restaurant. Beverage market report of strategic research and consulting firm CDI. Therefore, factors affecting external consumption channels make revenue and profit of beer traders decline.

At the shareholders meeting in 2020, Sabeco president admitted that the two biggest challenges in 2020 are the impact from Decree 100 and social isolation measures that have caused “beer consumption in restaurants to decline significantly”.

With the disease situation returning from the end of July, breweries will continue to face the risk of reduced consumption until the end of 2020, along with the eating and spending habits of users also change.

Report on consumer behavior during the Covid-19 epidemic by Kantar Vietnam said that spending on “beer” products fell 24% in just the first two months of the year. Luxury goods, alcohol and “non-essential” products are forecast to be hit hard even after the epidemic ends.

SSI Research also forecasts that beer production growth in 2020 may not reach double digits, the growth will be stable at around 6-7% by the end of this year due to the impact of Decree 100 and the Covid epidemic- 19.

Linh Chi – Forbes Vietnam

Thiết kế website bởi Mona Media